July 26, 2023

India to Russia: Exploring export potential of beauty products

Indian beauty products are finding a welcoming market in Russia due to the current supply crunch in the latter’s market. The alignment of consumer preferences, such as the demand for natural and organic products, presents significant export potential for Indian brands. However, the opportunity has to be grabbed in the nick of time before it is too late.

This article focuses on the potential opportunities for India’s beauty product exports to Russia and suggests a sustainable roadmap for both countries to deepen bilateral integration.

Image Credit: Pexels

India’s Beauty Market Overview

Beauty may be in the eye of the beholder, but there is little debate when it comes to the long-term attractiveness of the beauty industry. India is the 8th largest beauty and personal care market globally. In 2022, the market size reached US$ 26.3 billion, which is expected to reach US$ 38 billion by 2028, with a CAGR of 6.45% (2023-28).

Fragrances, makeup and cosmetics, and men’s grooming segments are expected to grow at a CAGR of 12-16%. Furthermore, an awareness of the possible perils in consistently using chemical formulations drove the growth of herbal products, which are expected to grow around 15-20%.

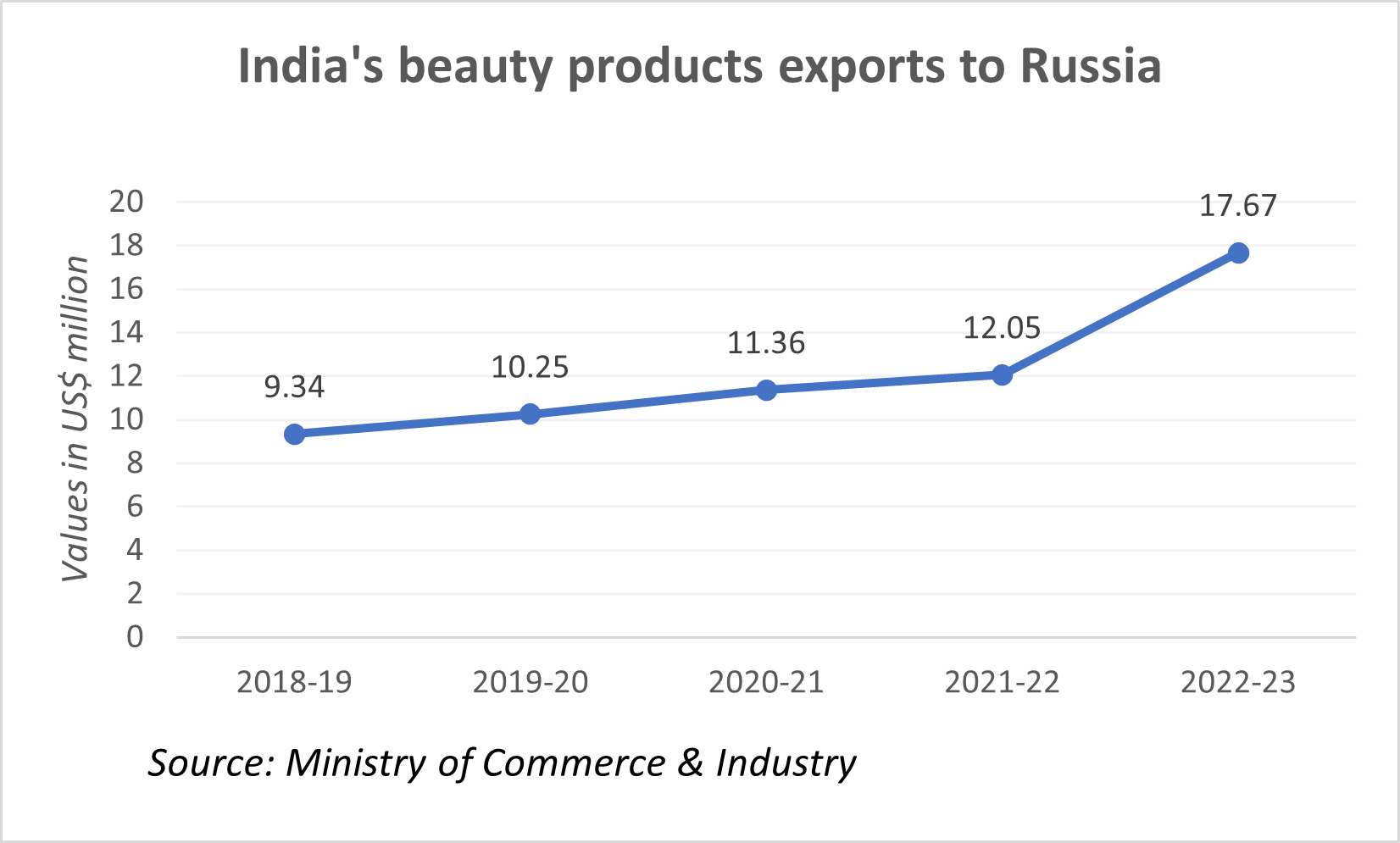

India is a major exporter of beauty products, and its exports have been growing steadily in recent years. In 2022-23, India exported US$ 2.38 billion worth of Essential oils and Resionoids, (HS 33), establishing 7% YoY growth. Indian beauty products have found their way into various corners of the world, with top export destinations being the US (US$ 425.08 million), UAE (US$ 412.46 million), China (US$ 111.34 million), Nepal (US$ 74.57 million), and Bangladesh (US$ 69.27 million). However, one market that has been rapidly embracing Indian beauty offerings is Russia. According to the Department of Commerce, Government of India, India’s exports of beauty products to Russia reached US$ 17.67 million in FY 2022-23 to Russia, registering a 17% CAGR since 2018-19.

This is further substantiated by Rajesh Vasudevan, AVP Business Development- Exports, Godrej Consumer Products Ltd. during a webinar organised by IBT on the potential of Indian beauty products exports to Russia, where he mentioned that our personal care industry, characterized by market stability, inventive products, and strong leadership, is driving significant growth. He added that India is witnessing a trend towards personalized solutions, with men’s grooming products gaining traction. The demand for fragrances and freshness is on the rise, and India’s expertise in the herbal and Ayurvedic segment makes us one of the leading exporters globally.

Russia’s Beauty Market Overview

Russia has a growing demand for beauty and personal care products. Consumers in the Russian market are showing an increasing interest in high-quality cosmetics and skincare products. The country’s beauty and personal care market amounts to US$ 15 billion growing annually by 2.17%. The market’s largest segment is Personal Care with a value of US$ 5.02 billion in 2023. Russia’s imports of beauty products reached US$ 2.62 billion in 2022, making it the 17th largest importer in the world. Germany (US$ 383.04 million), France (US$ 288.49 million), and South Korea (US$ 287.44 million) were the top source countries for the year.

Russian consumers are increasingly interested in high-quality organic beauty products. Growing awareness about the benefits of natural ingredients, the availability of diverse distribution channels, and the preference for branded products are key drivers influencing demand. Additionally, the ageing female population’s demand for anti-ageing products and the focus on environmental sustainability by companies have further contributed to the popularity of organic beauty products in Russia.

Viktoria Mysak, the founder and owner of INDI House in the webinar brought three major Russian beauty trends into the limelight:

- Firstly, there is a growing demand for natural components in cosmetics, driven by increased consumer trust in brands that prioritize natural ingredients and ecological sustainability. The market volume for pure cosmetics in 2022 was $42 billion, with experts predicting a rise to $54 billion by 2027.

- Secondly, personalization plays a significant role, as consumers appreciate brands that address their individual needs and offer tailored advice. About 80% of people prefer to purchase from brands that provide a personalized approach.

- Lastly, the market for men’s cosmetics is rapidly expanding, contrary to traditional stereotypes, and the pandemic has further increased interest in hygiene and grooming products for men.

Roadmap for Both the Countries to Strengthen the Bilateral Relations

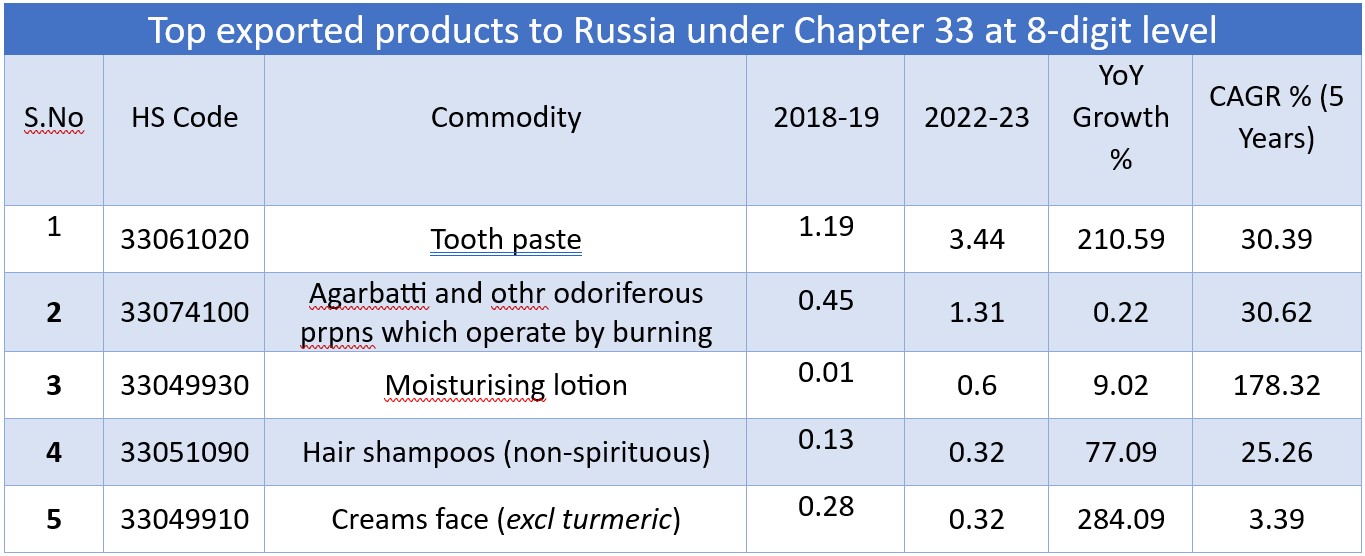

India and Russia have nurtured a stable and multifaceted relationship. As both nations harness this relationship for enhancing their trade, the relationship between India and Russia is poised to grow even stronger in the years to come. Russia is an emerging destination for India’s beauty products, and its imports from India have been growing rapidly. The top export items from India to Russia include hair care products, skincare products, and makeup.

Russian consumers’ preference for organic and herbal beauty products aligns well with the offerings of Indian beauty brands. Indian brands are known for their high-quality products at competitive prices and their commitment to utilizing natural ingredients. Additionally, Indian brands have a strong track record of innovation, a crucial factor in a competitive market like Russia.

Source: Ministry of Commerce & Industry; HS 33 corresponds to Essential oils and resinoids; perfumery, cosmetic or toilet preparations.

However, venturing into the Russian market does come with its share of challenges. The language barrier poses difficulties for Indian brands that do not have a strong foothold in Russia. Cultural differences also play a role, as Russian consumers have distinct expectations compared to consumers in other parts of the world. Price sensitivity is another consideration, as Russian consumers tend to seek affordable options.

Building brand awareness and reputation is crucial for Indian beauty brands entering the Russian market. Strategic marketing efforts, including advertising, influencer collaborations, and fostering positive customer experiences, can help overcome the limited brand recognition among Russian consumers. It’s important to note that Russia imposes high import duties on beauty products, which can affect the competitiveness of Indian brands.

According to Prasun Prakash, General Director at DRISP, India needs to enter the Russian market right now because If India doesn’t step in, someone else will. Speed is of the essence to ensure that India fills the void and establishes a strong presence. He added, “One more important thing that I want to outline here is that the 70% of the cosmetics market was basically more or less held by the foreign brands. When we say foreign brands, we speak of companies from countries that are not in friendly terms with the Russian Federation at the moment.”

Despite these challenges, the opportunities in the Russian beauty market outweigh the obstacles. With its large and growing consumer base, increasing disposable income, rising popularity of online shopping, and growing demand for natural and organic beauty products, Russia presents a promising landscape for Indian beauty brands.

Saket Mishra, Head-Export and International Sales, Fabindia shares his experience, “Russia is actually a very deep market where we can explore diverse areas of potential in cosmetics. Our personal experience is basically for Henna products, moisturizers, body butters, as well as serum-based products and natural soaps. We have marketed these products in other CIS countries as well, including Kazakhstan, Uzbekistan, Turkmenistan, Ukraine and Belarus. There is a brotherhood between India and Russia that we are seeing from the years and years. There is high acceptability for Indian products in that particular market.” Zubin Contractor, CEO, Mitchell Group, expresses confidence that Indian companies can fulfil the untapped demand in the Russian market. He added that although there is a strong perception in favour of American and European brands, India can offer the same quality of cosmetics at much better prices.

The emergence of e-commerce in Russia is opening up new avenues for Indian beauty brands to expand their reach. With 127.6 million internet users and a high internet penetration rate of 88.2%, Russia offers a vast online consumer base. Additionally, the country’s 106 million social media users further enhance the potential for digital marketing and brand exposure. By leveraging the growth in e-commerce, Indian beauty brands can tap into this vast Russian consumer base, showcase their products and expand their presence significantly.

The relationship between India and Russia in the beauty industry is thriving, with Indian beauty products finding a welcoming market in Russia. The alignment of consumer preferences, such as the demand for natural and organic products, presents significant export potential for Indian brands. Despite challenges including language barriers and high import duties, the growing e-commerce market in Russia offers a roadmap for Indian beauty brands to expand their presence. By seizing this opportunity, India and Russia can strengthen their bilateral integration and unlock the immense bilateral potential of beauty products trade.